Housing Affordability Concerns Grow in Nevada Amidst Legislative Actions

“[R]enters and lower-income voters are worried about being locked out of home ownership forever.” – Las Vegas Review-Journal

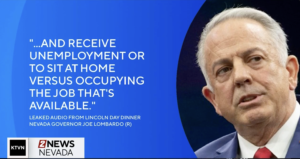

Amid rising concerns about the cost of housing in Nevada, a recent survey revealed that over 80% of Nevadans believe housing has become unaffordable under Joe Lombardo’s leadership. This sentiment comes as Reno’s median home price surpassed $600,000 in April, and Clark County’s median home sale prices hit a record $485,000 in January. Despite these rising costs, Lombardo vetoed several bills intended to reduce housing expenses, exacerbating the situation.

Lombardo’s Vetoes and Their Impact on Housing Costs

Lombardo’s decision to veto various legislative measures has been directly associated with the surge in housing costs:

- Lombardo rejected AB218 and SB78, which aimed to safeguard renters from hidden and predatory fees by landlords.

- The Las Vegas Review Journal reported that Greystar, a real estate giant, collected over $100 million in “hidden fees” from tenants in Nevada and beyond.

- He also vetoed AB340, which would have aligned Nevada with national practices by requiring landlords to initiate summary eviction proceedings in court.

- As a result, Clark County now faces one of the highest eviction rates in the nation, with over 47,000 evictions recorded in the past year, up from 30,000 evictions in 2023.

- In 2023, Lombardo vetoed SB395, aimed at restricting corporate acquisitions of residential properties, particularly starter homes in low-income areas.

- Subsequent reports indicate that a New York hedge fund has become the largest homeowner in Clark County, contributing to the struggle of working-class families to afford home ownership.

Read More Here

Be First to Comment